|

Minerals Exploration Statistics |

|

This page takes a broader look at

minerals exploration in the Northern Territory and further afield. It summarises the

current economic situation of mineral explorers in Australia and presents data on the

levels of exploration on Aboriginal land.

- Due to the fall in commodity prices in 1998 (spot prices

for uranium fell to less than US$10/lb) the overall situation for mineral explorers is not

bright. In mid 1998 nearly half of the 300-odd mining exploration companies on the

Australian Stock Exchange had all but run out of cash. As at June 30 more than 120 junior

explorers had less than $500,000 in cash and 60 had less than $200,000. Many are

desperately seeking joint-venture partners or negotiating mergers. Maybe 25% of junior

explorers will go out of business (The Bulletin 10/11/98: p54).

- Companies with mine earnings were generally able to

weather the commodity price downturn. However, those without cashflow - including mineral

explorers - were trampled by the investor stampede into safer stocks. The All Resources

Index lost 8.5% between 31 December 1997 and 30 November 1998. The Eyres Reed Explorers

Index lost 16% (Australia's Mining Monthly Dec 1998 - Jan 1999).

- No wonder then that the NT Government announced the NT

Exploration Initiative in 1998. An initial outlay of $0.5 million was added to the NTDME's

budget for 1998/99 to promote geological surveying and mapping activity. A further $15.5

million will be spent by 2002/03. NT Minister for Resource Development Daryl Manzie said,

"mineral and petroleum exploration is the lifeblood of the mining industry and

underpins the economy of the NT" (NTDME 1998a).

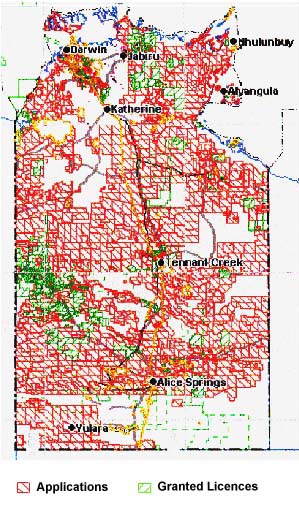

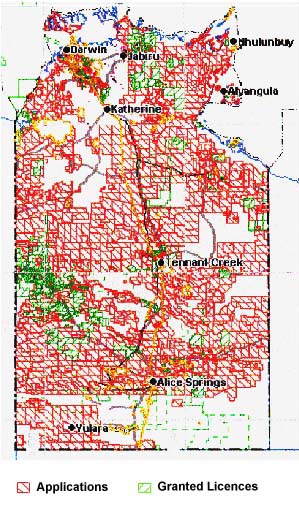

Exploration Licences in the Northern

Territory, June 2001

Source: NT Department of

Mines and Energy

Currently the NT occupies 18% of Australia's land mass but

receives only 7% of exploration investment. In total 456 ELs are held covering 107,724

square kilometres or 8% of the NT. Moreover, the four largest mines (Ranger, Nabalco,

McArthur River, and GEMCO) account for 60% of the value of mining production, which in

1997/98 totalled $1.4 billion (NTDME 1998a; 1998b).

Expenditure on exploration in the NT had declined from $89

million in 1996/97 to $76 million in 1997/98 (NTDME 1998b). Most of this expenditure was

spent on 'Brownfields' exploration (proving up known resources on granted leases) rather

than 'Greenfields' exploration (exploring for new deposits). The NT Government blames

native title uncertainties. 287 ELs were affected by the NT Government's freeze on

applications on land where native title is at issue. Since then the freeze has been lifted

so that the NLC has been inundated by a flood of applications.

In 1997/98, 63 applications were received for ELs on

Aboriginal land. In the same year 19 were granted (NTDMEb 1998b).

As at 30 June 2000, the NLC had processed well over 200

exploration licence applications, of which 76 had progressed to exploration licences.

These cover nearly 46500 km2, so that 30.5% of Aboriginal land in the NLC

region is available for exploration. In addition, the NLC was involved in negotiations for

7 ELAs covering 14500km2 of Aboriginal land in the NLC region.

- At present a total of 39.9% of Aboriginal land in the

NLC region is subject to an ELA or undergoing negotiation towards the grant of an ELA. A

summary of this information is shown in the tables below (NLC Annual Report 1999-2000).

EXPLORATION

LICENCE APPLICATIONS IN THE NORTHERN LAND COUNCIL REGION 1999-2000 |

| Aboriginal land under

Exploration Licence Agreements |

30.5% |

46500km2 |

| Aboriginal land under

ELA negotiation |

9.4% |

14500km2 |

| Aboriginal land for

which ELAs are being processed |

27.7% |

42300km2 |

| Aboriginal land which

has been placed in moratorium |

20.8% |

31700km2 |

| Aboriginal land not

under application |

11.6% |

18000km2 |

| Status |

No.

of ELAs 1 July 1999 - 30 June 2000 |

Cumulative

total to 30 June 2000 |

| Application

due |

9 |

141 |

| Deemed

withdrawn |

1 |

187 |

| Lapsed |

4 |

41 |

| Applications

received |

7 |

300 |

| Under

consideration by traditional owners |

3 |

N/A |

| Negotiations

in progress |

7 |

N/A |

| Refused

by NLC |

22 |

144 |

| Number

of consents given to the grant of exploration licences |

Nil |

76 |

- At a broader scale, Australian resident companies

spent $379 million in exploration for minerals overseas in 1997/98, down 14% on 1996/97.

22% of this investment is targeted at Latin America ($85 million), with Africa getting $76

million and North America $60 million (Minerex Report Vol 7 No. 1 Jan 1999: p12).

More than 40% of Australian exploration investment currently heads overseas (NTDME 1998a).

Refs

Northern Land Council 1998 NLC Submission to the

Land Rights Act Review.

Northern Territory Department of Mines and Energy 1998a The

Northern Territory Exploration Initiative, Darwin.

Northern Territory Department of Mines and Energy 1998b Annual

Report 1997/98, Darwin, October 1998.

Supervising Scientist 1997 Annual Report 1996-97,

AGPS, Canberra.

Uranium Information Centre 1999 Uranium Markets: Nuclear

Issues Briefing Paper 36, January 1999.

|